workers comp taxes texas

Yep theres not even state income tax in the Lone Star State As an employer youll pay Texas Unemployment Insurance You can obtain your tax rate by visiting the Texas. The rate in Texas is currently 625 at the state level although cities counties districts and other local taxing jurisdictions can impose their own additional rate of 2 for a combined total sales use tax rate of 825.

Are The Benefits From Workers Compensation Taxable In Texas D Miller

But theres more to taxes than merely paying themknowing which business taxes to pay when to pay them and how to set up your business to account for future tax payments can spare you a ton of headaches when it comes time to write the.

. Be an employee 2. Ohio-based businesses must obtained workers compensation coverage through the Ohio Bureau of Workers Compensation BWC but we do offer ADPs Pay-by-Pay service to Ohio clients. Colorado doesnt require workers compensation for realtors and construction work under 2000 per calendar year.

ADPIA then remits those premium payments to the Ohio BWC. September 5 2017. They often need to get workers comp too.

Beginning in mid-January you can find the amount of benefits we paid you and any federal taxes withheld on Unemployment Benefits Services View IRS 1099-G Information or. Texas Workers Compensation Act 86th Texas Legislature R 2019 in HTML Format Texas Legislative Council website SUBTITLE A. The incentive for this illegal behavior is strong.

If youre shopping for workers comp you may be wondering who the biggest workers comp insurers are. Some states require workers comp only above a certain number of employees. Close or sell your business.

18113 and 18114. Companies dont have to pay payroll taxes overtime pay or offer benefits to independent contractors. For example Alabama requires workers comp insurance when five or more employees work at a business.

Merge and acquire businesses. If payday is less than five days after last day of work employer may pay on the following payday or 20 days after last day of work whichever is earlier. As Oracle Palantir and Hewlett-Packard Enterprise move their headquarters out of California experts say the state needs to find ways to reverse the trend.

Texas Mutual Insurance Co. New York New Jersey and Massachusetts but would be nonstarters in other big right-to-work states such as Florida and Texas. And if your boss offers you some incentive in an attempt to persuade you against filing a workers compensation claim this is illegal.

TEXAS WORKERS COMPENSATION ACT. Everyone in construction must have workers comp. Immediately upon demand by employee.

For most small business owners government regulation questions almost always begin with taxes. By contrast Texas does not require employers to. DOT Workers Comp complex language and critical laws.

Best Tax Software. Call 888-611-7467 for a Workers Compensation Specialist. Options to manage your current workers comp policy or shop and secure policy coverage.

For-profit employers pay federal FUTA and state unemployment insurance UI taxes on wages paid. October 5 2017. If employee is fired.

Injuries Personal Workers Comp Injury Accidents Auto Wrongful Death Insurance Auto Health Life Property. Become a federal contractor. Employer has insurance 3.

Moreover similar injuries can yield vastly sometimes cruelly different results even when they occur in neighboring. Workers comp insurance costs small business owners an average of 47 a month or 560 annually according to Trusted Choice a group for independent insurance agents. COLLECTION OF TAX AFTER WITHDRAWAL FROM BUSINESS.

The Texas Workforce Commission has partnered with IDme an identity verification service to protect your personal information and prevent unemployment benefits fraud. We would like to show you a description here but the site wont allow us. The state does however allow injured.

The state of Texas may be big but its list of payroll taxes is small. Indiana requires Contractors in the building and construction trades to become certified with the Indiana Workers Compensation Board. There is only one state payroll taxunemployment insurance and it is paid by the employer.

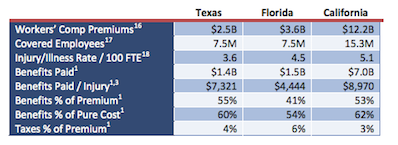

You have the right to say no The laws in each state provide that you can pursue a workers compensation claim without fear of reprisal or. Hire employees with disabilities. According to the National Academy of Social Insurance employer costs for workers compensation insurance ranges from 055 per 100 of covered payroll in Texas to 225 per 100 of covered.

Laws 408474 and 408475 Minnesota. Buy assets and equipment. No small business owner can start running their own payroll taxes without knowing their states rates for sales and use taxes.

In Texas workers compensation isnt mandatory except for governmental construction contracts. This benefit enables the insured to have their premiums calculated on actual payroll runs. We take the weight off your shoulders so you can concentrate on hauling more freight.

Expand to new locations. Exempt and non-covered employees include domesticcasual workers who make under 1500 from their employer during the 12 consecutive months before injury agricultural workers whose employer has a cash payroll of less than 2500 in the calendar year before the injury agricultural exchange labor and officers of a family farm corporation as. TLC can handle everything from payroll taxes benefits and workers comp to assisting you with driver training and government compliance and much more.

Sole Proprietors Partners Corporate Officers and LLC Members who are included for workers comp coverage must do so at a payroll between 41600 and 192400 annually. However coverage may be provided by a business they sub-contract with. 5 requirements for workers comp eligibility.

1099 Independent Contractor Questions. What you need to know A federal court in Texas has blocked the implementation of the federal overtime. Workers Comp Exemptions in Indiana.

Inside Corporate America S Campaign To Ditch Workers Comp Business Ethics

Price Check How Companies Value Body Parts

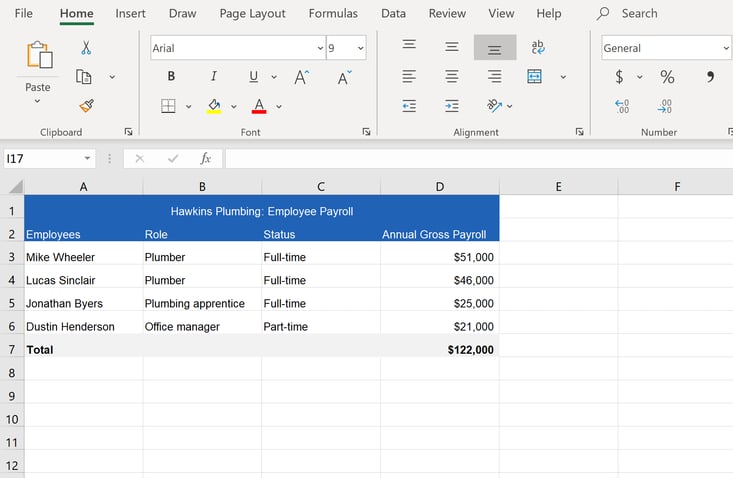

How To Calculate Workers Compensation Cost Per Employee

How To Avoid Paying Taxes On A Lawsuit Settlement

Workers Compensation Insurance The Small Business Owner S Guide Bench Accounting

What Is Workers Compensation Article

Is Workers Comp Taxable Hourly Inc

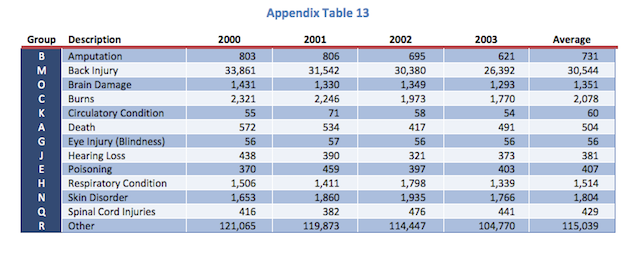

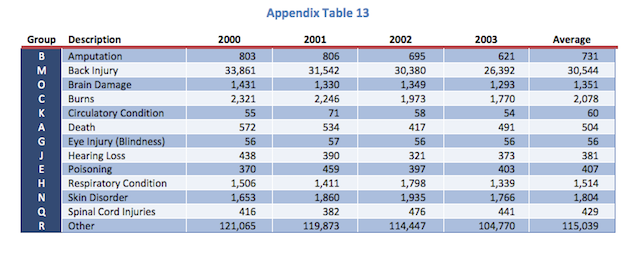

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

2022 Federal State Payroll Tax Rates For Employers

Workers Compensation In Texas A Brief History International Development 18 Th Century Pirates 1 If You Survived The Injury No Death Benefits Loss Ppt Download

Texas Non Subscriber How Can Injured Worker S Get Compensation

Are You Eligible For Workers Compensation Patrick Daniel Law

Texas Workers Compensation Insurance Laws Forbes Advisor

Texas Workers Compensation Laws Costs Providers

Is Workers Comp Taxable Workers Comp Taxes

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Texas Small Business Scorecard March 2019

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation